In an effort to assist business correspondents (BCs) towards delivering banking services to unbanked poor as part of national financial inclusion mission, the Unique Identity Authority of India (UIDAI), spearheading the initiative, has mooted using microATM devices for the purpose.

The authority, stating that microATM devices be used by BCs to deliver basic banking services at the last mile, said a committee consisting of itself, Indian Banks’ Association, RBI besides various banks went into specifications and uses of the device.

microATM is a first step towards providing online, interoperable, low-cost payments platform to everyone in the country, the authority said. The device, would take its design and system architecture from debit/credit card processing on point-of-service (POS) terminals and combined with authentication services UIDAI will provide.

The microATM deployed by banks either directly or through service providers (individual BCs/ sub-agents of corporate BCs), will be based on bank-led model for financial inclusion providing basic transactions such as deposit, withdrawal, funds transfer, balance enquiry and mini-statement.

The objectives, it said, are to bring down transaction costs, security and transparency of transactions, uniform customer experience and reduce agent training needs. The device can be also deployed by service providers to provide variety of other financial and value-added services, it noted, adding these services will generate increased cash-flows for microATM agents.

Presenting scenarios of last mile collection problems such as interest payments for micro-finance loans, premiums for micro-insurance policies, contributions to micropensions accounts, investments in micro-mutual funds, it said these could be be solved with microATMs.

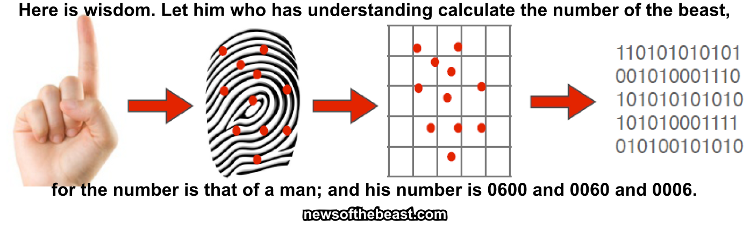

The device will allow customers to perform basic financial transactions using their UID number and their fingerprint as identity proof (along with Bank Identification Number for inter-bank transactions). Unlike ATMs, cash-in/ cash-out functions, of microATMs will be performed by the operator, bringing down cost of device and cost of servicing the customer.

The goal is to leverage UIDAI’s online fingerprint authentication for banking transactions, without requiring major change to existing banking infrastructure, the authority said adding the microATM functionality has been restricted to small set of transactions, so that it can be robust and simple, but scaled for ubiquitous nationwide deployment.

No comments:

Post a Comment